how far back does the irs go to collect back taxes

When the statute of limitations will expire or how far back the IRS can go depends on a number of variables. There is an IRS statute of limitations on collecting taxes.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

. Need help with Back Taxes. Ad The IRS contacting you can be stressful. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

IRS Previous Tax Returns. When there is substantial underreporting andor more complicated issues such as unreported. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

Under most circumstances the Internal Revenue Service has three 3 years to audit a taxpayer. The irs is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. An IRS Audit Can.

For most cases the. Start with a free consultation. However that 10 years does not begin when you neglect either accidentally or willfully to file your return.

The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Posted on Feb 28 2013.

IN GENERAL the IRS has 3 years from the. Note that the statute of limitations on collections used to be six years but now. This means that the IRS has 10 years after assessment to collect any taxes you owe.

Most of the time the IRS. It is true that the IRS can only collect on tax debts that are 10 years or younger. How Far Back Can the IRS Audit You.

Once the IRS has assessed the tax it has 10 years to collect it from the date of assessment. There is a 10-year statute of limitations on the IRS for collecting taxes. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

We work with you and the IRS to settle issues. How Many Years Back Can IRS Audit You. At the very most the IRS will go back six years in an audit but that only happens if the agency identifies a serious error.

The time period called statute of limitations. In most cases the IRS goes back about three years to audit taxes. After that the debt is wiped clean from its books and the IRS writes it off.

A common question we receive is How far back can the IRS audit you The answer depends on the facts. This is a general rule. To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account.

Why Some Americans Should Still Wait To File Their 2020 Taxes

Irs Enters Tax Season In Crisis That Could Delay Refunds

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Far Back Can The Irs Collect Unfiled Taxes

Irs Wage Garnishments El Paso Tx Villegas Law Cpa Firms Wage Garnishment Problem And Solution Irs

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Link Aadhaar To Income Tax Return Tax Payment Income Tax Irs Taxes

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Irs Tax Refund Identity Theft How It Can Happen To You Irs Taxes Tax Refund Identity Theft

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Irs Refunds When Is The Irs Accepting 2022 Tax Returns Marca

Faqs On Tax Returns And The Coronavirus

Where S My Tax Refund Check When You Ll Get Your Irs Payment Cnet

Know What To Expect During The Irs Collections Process Debt Com

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

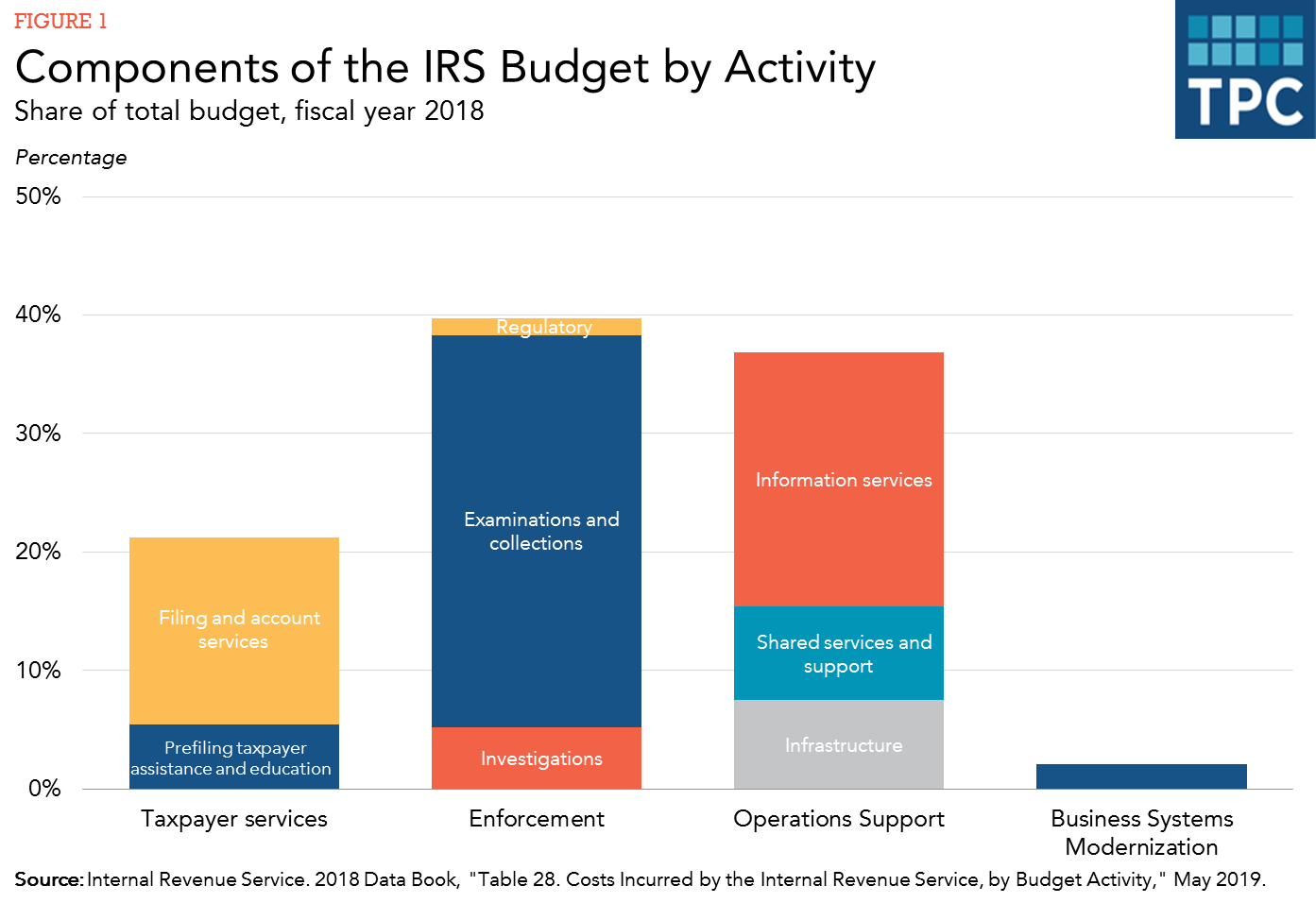

What Does The Irs Do And How Can It Be Improved Tax Policy Center

How The Upcoming Sales Tax Holiday Can Boost Your Back To School Savings Tax Holiday School Savings Sales Tax